Picture this: You're standing in front of a vending machine at 2 AM, desperately craving that overpriced energy drink. You feed in your crumpled dollar bills, press B4, and—thunk—out comes your caffeine fix. No cashier needed, no small talk required, just a simple transaction that works exactly the same whether it's Tuesday afternoon or Sunday at midnight.

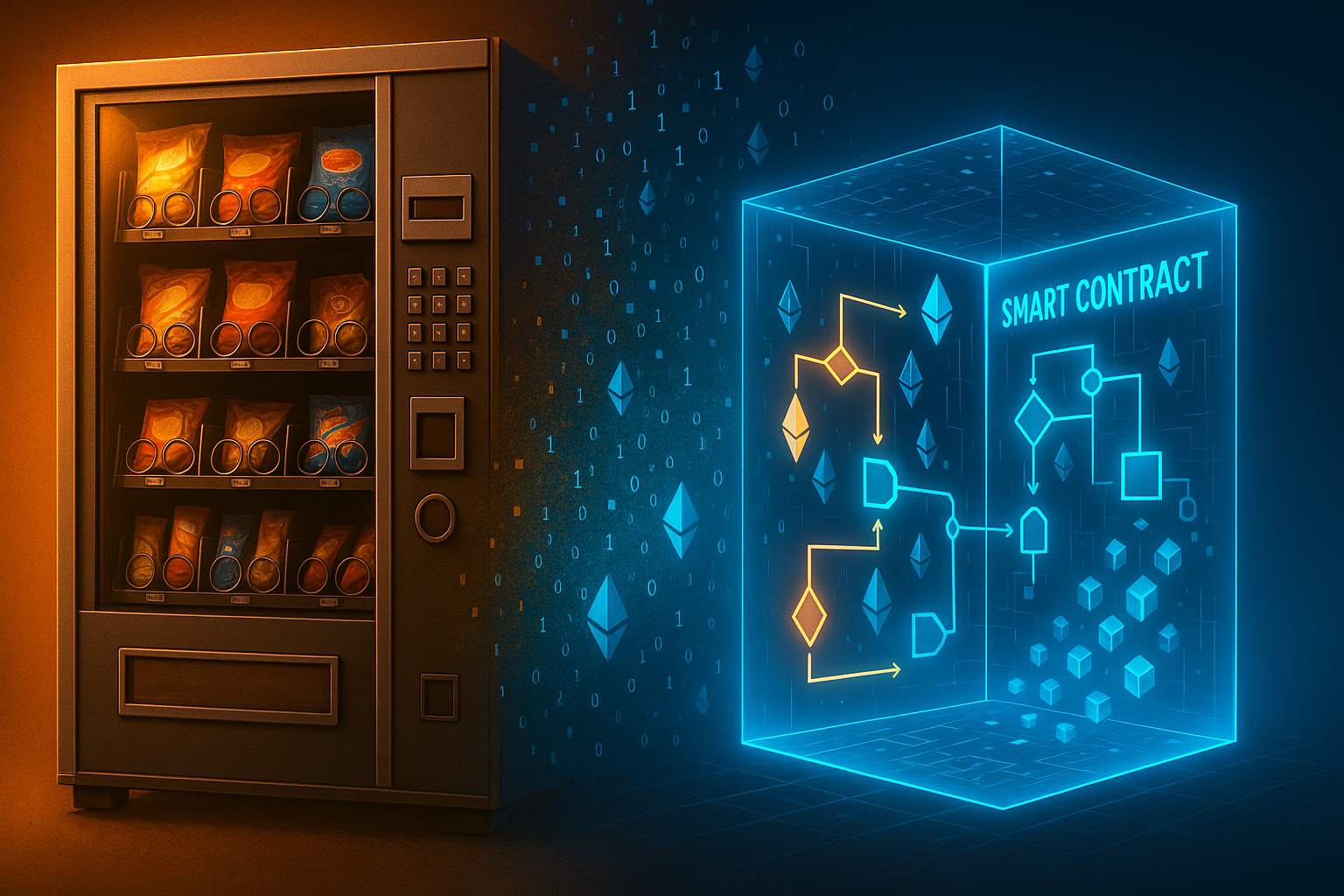

Here's the thing: this mundane interaction you've had a thousand times? It's basically how smart contracts work on the blockchain. And understanding this connection is your gateway to finally making sense of all that crypto contract talk you keep hearing about.

What You'll Understand After Reading This

By the time you finish this article, you'll know exactly how smart contracts work—without needing a computer science degree. You'll understand why everyone compares them to vending machines (and where that comparison falls apart). Most importantly, you'll be able to spot the difference between legitimate smart contract uses and the overhyped nonsense that floods crypto Twitter.

Plus, you'll learn how to actually check what a smart contract does before you interact with it, because trust me, not all digital vending machines dispense what they promise.

The Vending Machine Connection: Why Everyone Uses This Example

Nick Szabo, the computer scientist who invented the concept of smart contracts back in the 1990s, called vending machines "the primitive ancestor of smart contracts." And honestly? He nailed it.

Think about what happens when you use a vending machine:

- You insert money (input)

- The machine verifies you've paid enough (condition check)

- It releases your snack (automatic execution)

- No take-backs—once that candy bar drops, it's yours (irreversible)

Smart contracts follow this exact same logic, just with cryptocurrency instead of quarters and digital assets instead of Snickers bars.

Where the Comparison Actually Works

The real magic of both systems is that they eliminate the middleman. You don't need to trust the vending machine operator to hand you your chips after paying—the machine handles it automatically. Similarly, smart contracts execute trades, release payments, or transfer ownership without requiring a lawyer, broker, or any other intermediary to oversee the process.

Both systems are also transparent about their rules. A vending machine shows you exactly what you'll get for your $2.50. A smart contract's code is visible on the blockchain, showing exactly what will happen when conditions are met (though admittedly, reading Solidity code is harder than reading "Doritos - $2.50").

Where the Vending Machine Analogy Breaks Down

Now, here's where things get interesting—and where most explanations stop. The vending machine comparison is great for understanding the basics, but it misses some crucial aspects that can trip up beginners.

Smart Contracts Can't Be Unplugged

When a vending machine breaks or starts eating bills without dispensing snacks, someone can shut it off, fix it, or update the prices. Smart contracts? Not so much. Once they're deployed on the blockchain, they run forever—bugs, exploits, and all. It's like launching a vending machine into space; you better hope you got everything right the first time.

The Hidden Costs Nobody Mentions

Using a vending machine costs exactly what's on the price tag. But smart contracts have this extra fee called "gas" that you pay to the network for processing your transaction. Imagine if vending machines charged you $1.50 for the soda PLUS a "machine operation fee" that varied from $0.50 to $50 depending on how many other people were using vending machines at that moment. That's gas fees in a nutshell.

They Can't See the Real World

A modern vending machine might reject your wrinkled dollar bill or tell you it's out of stock. But smart contracts are surprisingly blind—they can't check weather conditions, stock prices, or whether the Lakers won last night unless you specifically feed them that information through something called an "oracle." It's like having a vending machine that can't tell if it's actually out of Coke.

Real Smart Contracts in Action (Not Just Crypto Trading)

Forget the complex DeFi yield farming strategies for a minute. Here are smart contracts doing real work in ways that actually make sense:

Insurance That Pays Out Automatically

Flight delayed? Some travel insurance now uses smart contracts that automatically send you compensation when your flight is more than 2 hours late. No claim forms, no waiting 6-8 weeks, no arguing with customer service. The smart contract checks flight data and pays out immediately if conditions are met.

Real Estate Without the Paperwork Mountain

Companies like Propy are using smart contracts to handle property sales. When the buyer's payment clears, the smart contract automatically transfers the property title. What used to take 30-60 days of paperwork can happen in hours. (Though yes, you still need traditional legal documents—smart contracts supplement rather than replace the legal system.)

Supply Chain Tracking That Actually Works

Walmart uses smart contracts to track food from farm to store. When a shipment arrives at a distribution center and gets scanned, the smart contract automatically releases payment to the supplier and updates the tracking system. If there's a contamination issue, they can trace the source in seconds instead of days.

Common Fears and Misconceptions (Let's Address the Elephant in the Room)

"What If Someone Hacks the Contract?"

Remember the DAO hack in 2016? Hackers exploited a bug to steal $50 million worth of Ethereum. More recently, Crema Finance lost $8.78 million to a smart contract vulnerability. These aren't isolated incidents—they happen because code can have bugs, and on the blockchain, bugs can be very expensive.

But here's the context that usually gets left out: thousands of smart contracts run perfectly every day. The key is using well-audited contracts from reputable sources, just like you'd use a vending machine in a store rather than a sketchy one in a dark alley.

"Can I Get My Money Back If Something Goes Wrong?"

Short answer: nope. Smart contract transactions are irreversible by design. If you send money to the wrong address or interact with a malicious contract, that money is gone. It's like putting a dollar in a broken vending machine—except the vending machine is in another dimension and the dollar was actually $1,000.

This is exactly why tools that help you understand what a contract does BEFORE you interact with it are so crucial. (This is exactly what ChainDecode helps you understand—showing you in plain English what any smart contract will do with your funds before you commit.)

"Don't Smart Contracts Replace Legal Contracts?"

This is like asking if email replaced phone calls. Smart contracts are great for straightforward, definable conditions: "If payment received, then transfer token." But they can't handle nuance, interpretation, or unforeseen circumstances the way traditional legal contracts can.

Most successful implementations use smart contracts alongside traditional contracts, not instead of them. The smart contract handles the execution, while the legal contract handles the "what ifs" and edge cases.

The Technical Bits (For the Curious)

If you've made it this far, you might be wondering about some of the technical details. Here's what's actually happening under the hood:

How Contracts Actually Run

Smart contracts on Ethereum run on something called the Ethereum Virtual Machine (EVM). Think of it as thousands of computers around the world all running the same vending machine program simultaneously. They all have to agree on what happened, which is why it's so secure—but also why it costs money (those gas fees) to run.

What Gas Fees Actually Pay For

Every operation in a smart contract costs a certain amount of "gas." Simple stuff like adding two numbers might cost 3 gas units, while complex operations like sorting a list might cost thousands. The total gas needed multiplied by the current gas price (which fluctuates based on network traffic) equals your transaction fee.

A simple token transfer might cost $5-10 in gas fees on a normal day, but during high traffic, the same transaction could cost $50-100. It's like surge pricing for computation.

The Oracle Problem

Smart contracts can only see what's on the blockchain. They can't check your bank balance, the weather, or sports scores without help. Oracles are services that feed real-world data to smart contracts. But this creates a trust issue—if the smart contract is trustless but relies on a trusted oracle, is the whole system really trustless?

What Should You Actually Do With This Information?

Understanding smart contracts isn't just about satisfying curiosity—it's about protecting yourself and spotting opportunities in the evolving digital economy.

Before Interacting With Any Smart Contract:

- Check what it actually does. Never interact with a contract based on what someone tells you it does. Use tools to verify the actual code behavior.

- Start small. Your first smart contract interaction shouldn't be your life savings. Try simple, well-established contracts first.

- Understand the fees. Check current gas prices before transacting. That $10 NFT might cost $60 in gas fees during peak times.

- Look for audits. Reputable projects have their smart contracts audited by security firms. No audit? Major red flag.

Where to Learn More:

The jump from understanding the concept to actually using smart contracts safely is significant. Start with established platforms like OpenSea for NFTs or Uniswap for token swaps—these have been battle-tested by millions of users.

The Bottom Line: Smart Contracts Are Tools, Not Magic

Smart contracts are powerful automation tools that work exactly like vending machines in some ways and nothing like them in others. They excel at eliminating intermediaries and executing predictable transactions, but they can't handle complexity, can't be easily fixed, and definitely can't think for themselves.

The key to using them safely? Understanding what they do before you interact with them. Because unlike a vending machine that might eat your dollar, a poorly understood smart contract can eat your life savings.

Want to see exactly what a smart contract will do before risking your funds? That's where ChainDecode comes in. Instead of trying to decipher complex Solidity code, you can paste any Ethereum contract address and get a plain-English breakdown of every function, risk level, and potential red flag. It's like having x-ray vision for digital vending machines—you'll see exactly what you're getting before you insert your coins.

Remember: in the world of smart contracts, understanding the code is your best defense. And now you know enough to start that journey safely.