Last week, my friend texted me in a panic. He'd moved all his ETH to Arbitrum to save on gas fees, only to discover the "official" bridge he used was actually a phishing site. His funds? Gone. The worst part? He's not alone—Layer 2 networks now process 12 times more transactions than Ethereum mainnet, but most users have no idea they're playing by different security rules.

Here's the reality check: Layer 2s hold over $35 billion in total value locked, and hackers are paying attention. Arbitrum lost $140,000 to a signature exploit in March. zkSync got hit for $5 million in April. These aren't theoretical risks—they're happening right now, to real people with real money.

But here's what the doom-and-gloom headlines won't tell you: staying safe on Layer 2s isn't rocket science. You just need to know what to look for.

What You'll Understand After Reading This

You'll have a practical, no-nonsense checklist for evaluating Layer 2 security—the same framework security researchers use, translated into plain English. You'll know exactly how to verify contracts, assess bridge risks, and spot the red flags that scream "stay away." Most importantly, you'll understand why some Layer 2 risks are acceptable while others should send you running back to mainnet.

Because the future of Ethereum is happening on Layer 2. You might as well learn how to navigate it safely.

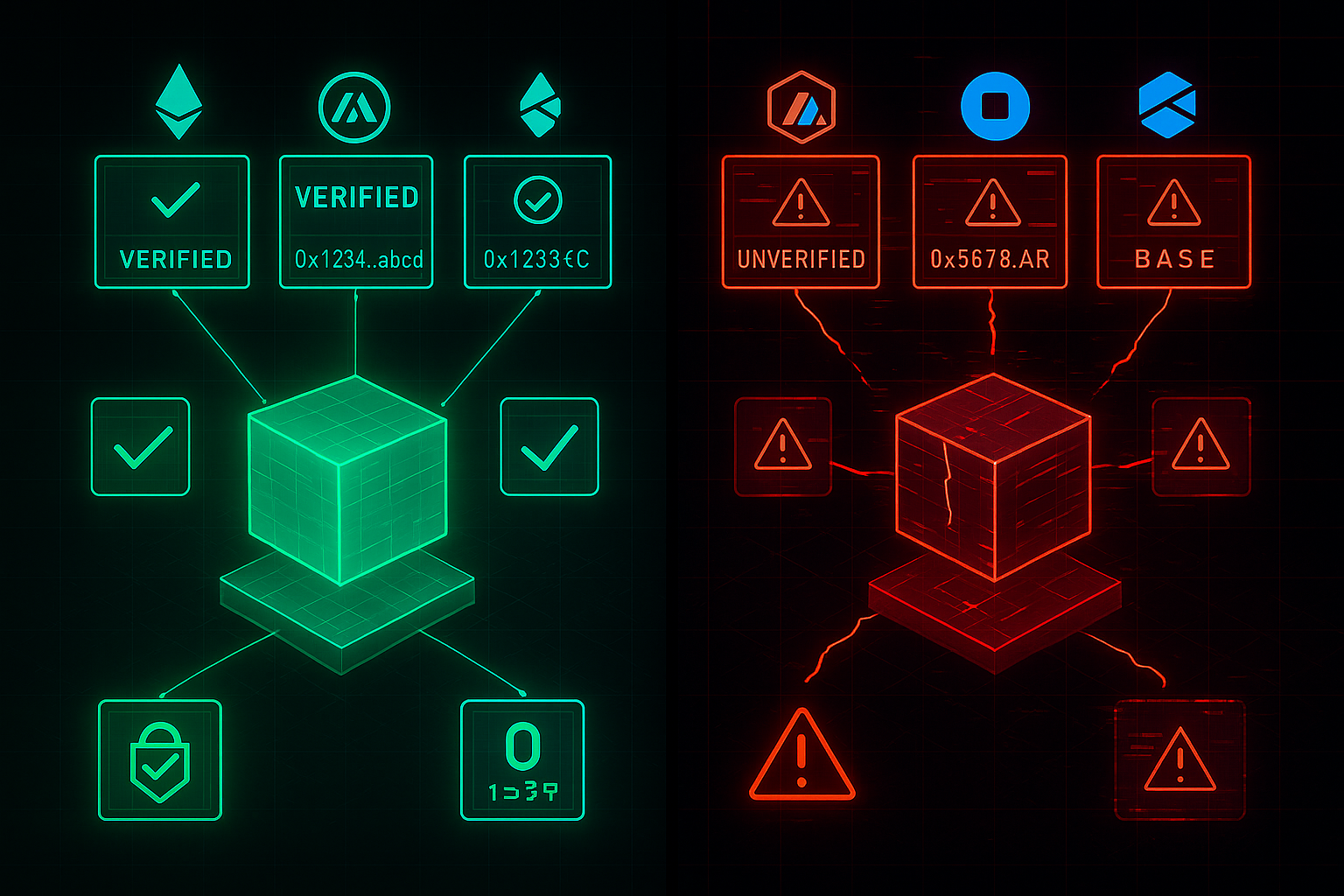

1. Verify Contract Deployments Across Chains (The "Is This Even Real?" Check)

Here's a fun fact that'll keep you up at night: the same contract address can be completely different things on different chains. That Uniswap contract on Ethereum? Could be a scam contract on Arbitrum using the exact same address.

It's like having identical house numbers on different streets—except one house is a bank and the other is a trap house.

How to Actually Verify Contracts

Step 1: Use Chain-Specific Addresses Never copy-paste addresses between chains. Always use the format that includes the chain identifier:

- eth:0x... for Ethereum mainnet

- arb1:0x... for Arbitrum One

- base:0x... for Base

This simple habit prevents 90% of cross-chain confusion attacks.

Step 2: Cross-Reference Multiple Explorers Don't trust a single block explorer. Check:

- Etherscan for the chain you're on

- The protocol's official documentation

- At least one independent explorer like Blockscout

If they don't all match, something's wrong.

Step 3: Look for Deployment Validation Legitimate protocols use tools like ChainSecurity's Deployment Validation Framework. These create a cryptographic proof that the contract deployed correctly. No validation? Major red flag.

Red Flags to Run From:

- Contract exists on one chain but not others where the protocol claims to operate

- Bytecode differs significantly between chains

- Deployment date doesn't match the protocol's announcement

- Missing verification on any chain

2. Assess Centralized Sequencer Risks (The "Who's Really in Control?" Check)

Time for an uncomfortable truth: most Layer 2s are about as decentralized as your local bank. They use centralized sequencers—basically gatekeepers who decide which transactions get processed and in what order.

Base? Coinbase runs the only sequencer. Arbitrum and Optimism? Also centralized. It's like having a bouncer at a club who can not only decide who gets in but also rearrange people in line for his friends.

Why This Matters More Than You Think

A centralized sequencer can:

- Censor your transactions: "Sorry, we don't process withdrawals today"

- Reorder for profit: Put their trades before yours (hello, MEV)

- Go offline: Remember Arbitrum's 8-hour outage? No sequencer = no transactions

How to Evaluate Sequencer Risk

Check for these safeguards:

Force Exit Mechanisms: Can you withdraw directly through L1 if the sequencer goes rogue? If not, your funds are effectively held hostage.

Redundancy Plans: Does the network have backup sequencers or failover mechanisms? Single point of failure = single point of "you're screwed."

Decentralization Roadmap: Is there a credible plan to decentralize? Or just vague promises about "future improvements"?

Mitigation Strategy:

Never put all your funds on one L2. Spread across multiple networks with different sequencer setups. Think of it as not putting all your eggs in one centralized basket.

3. Evaluate Bridge Security Protocols (The "Please Don't Get Hacked" Check)

Bridges are where the real money gets stolen. In 2022 alone, bridge hacks accounted for $2 billion in losses—that's 69% of all crypto stolen that year. And 2025 isn't looking much better.

Why? Because bridges are honeypots. They hold massive amounts of funds in smart contracts that connect different chains. It's like a vault with doors on multiple dimensions—more doors mean more ways for thieves to get in.

The Bridge Security Checklist

Audit History: Has the bridge been audited by multiple reputable firms? One audit isn't enough. Look for:

- Competitive audits (multiple firms racing to find bugs)

- Recent audits (within 6 months)

- Public audit reports you can actually read

Oracle Dependencies: How does the bridge know what's happening on other chains? Single oracle = single point of failure. The Ronin bridge lost $625 million because attackers compromised 5 out of 9 validators.

Validator Sets: Who validates cross-chain messages?

- Less than 10 validators? Too centralized

- All validators from one company? Run away

- Geographic distribution? Better, but check their track records

Bridge Type Matters

L2 Bridges (like Arbitrum's native bridge): Generally safer because both ends connect to Ethereum. One chain to rule them all.

Cross-chain Bridges (like Ethereum to Solana): Riskier because they connect independent chains that can't directly verify each other. More complexity = more attack vectors.

4. Understand Fraud Proof Mechanisms (The "Trust, but Verify" Check)

Here's where Layer 2s split into two camps, each with its own trust model.

Optimistic Rollups (Arbitrum, Optimism): "Innocent Until Proven Guilty"

These assume all transactions are valid unless someone proves otherwise. It's like a security system that only checks footage after someone reports a theft.

The 7-Day Problem: Withdrawals take a week because that's the challenge period. Anyone can dispute fraudulent transactions during this window. Annoying? Yes. Necessary? Also yes.

The Validator Problem: Arbitrum has been running since 2021 and has NEVER had a successful fraud proof submitted. Either their security is perfect (unlikely) or not enough people are watching (concerning).

Currently, only about 12 validators can even submit fraud proofs on Arbitrum. That's not exactly "decentralized" security.

ZK-Rollups (zkSync): "Guilty Until Proven Innocent"

These use cryptographic proofs to verify every transaction is valid before accepting it. No waiting period, but different trust assumptions.

The Setup Ceremony Risk: zkSync relies on a "trusted setup"—basically a ritual where people generate cryptographic parameters then promise to delete them. If someone kept copies, they could potentially forge proofs.

What to Check:

- How many validators actively monitor for fraud?

- Can anyone become a validator, or is it permissioned?

- For ZK rollups: How transparent was the trusted setup?

- Are there emergency pause mechanisms if fraud is detected?

5. Monitor Emergency Exit Mechanisms (The "Escape Hatch" Check)

Vitalik Buterin himself said the ability to exit L2 back to L1 is a crucial security feature. Yet many Layer 2s make this surprisingly difficult.

Think of it like a fire exit in a building. You hope you'll never need it, but when you do, it better work.

What Makes a Good Emergency Exit

Permissionless Withdrawals: You should be able to withdraw to L1 even if:

- The sequencer hates you

- The L2 is under attack

- The team rage-quits

- Regulators come knocking

Clear Documentation: Can you find the emergency exit instructions in under 5 minutes? If not, how will you use them in a crisis?

Tested in Practice: Has anyone actually used the emergency exit? Theory is nice, but practice matters.

Red Flags:

- No force-withdrawal function

- Withdrawal requires sequencer cooperation

- Documentation buried in technical specs

- No UI for emergency withdrawals—command line only

Test the emergency exit with a small amount before you need it. Better to know it works with $10 than discover it doesn't with $10,000.

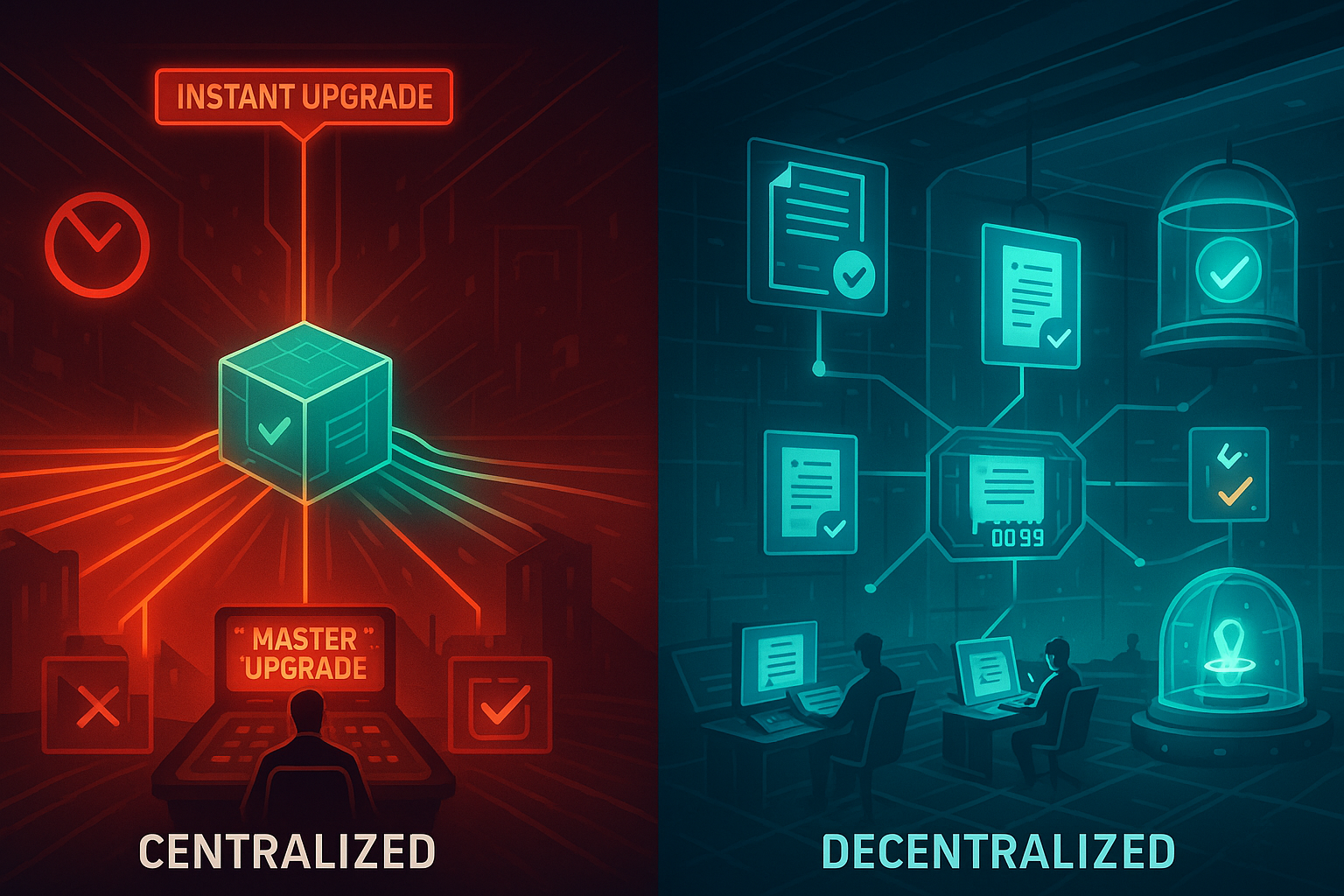

6. Analyze Governance and Upgrade Risks (The "Who Can Change the Rules?" Check)

Most Layer 2s can be upgraded. The question is: by whom, how quickly, and with what oversight?

Some protocols have a 2-of-3 multisig that can drain all funds with a single transaction. Others require a 4-week public review period before any changes. Guess which one's safer?

Governance Red Flags That Should Terrify You

Single Signature Control: One person can upgrade the entire protocol? That's not DeFi, that's "trust me bro" with extra steps.

No Timelock: Upgrades can happen instantly? Zero time to react if something goes wrong.

Opaque Process: Can't find information about who controls upgrades? They're hiding it for a reason.

What Good Governance Looks Like

Multi-signature Requirements: At least 5-of-9 multisig for critical functions. More signers = more security.

Timelock Delays: Minimum 72 hours for upgrades. zkSync's 4-week timelock is even better. Time to review = time to exit if needed.

Progressive Decentralization: Clear roadmap for reducing central control over time. Bonus points for specific dates and milestones.

7. Implement Comprehensive Due Diligence (The "Don't Be Lazy" Check)

Security isn't a one-time check—it's an ongoing process. Layer 2s evolve quickly, and yesterday's secure protocol might be today's vulnerability.

Your Monthly Security Checklist

Technical Review:

- Recent audits still valid?

- Any new features launched without audits?

- Sequencer uptime and performance metrics?

- Bridge security incidents on any connected chains?

Governance Monitoring:

- Any proposals to change key parameters?

- Team changes or departures?

- Multisig signer updates?

- Timelock modifications?

Risk Diversification:

- Too concentrated in one L2?

- Using multiple bridges unnecessarily?

- Holding more than you can afford to lose?

The 80/20 Rule of L2 Security

80% of your security comes from 20% of the checks:

- Verified contracts

- Multiple validators/sequencers

- Working emergency exits

- Proper governance timelock

- Recent audits

Focus on these five, and you're ahead of most users.

The Smart Contract Reality Check

Here's where things get meta. Every security feature we've discussed—emergency exits, governance controls, bridge mechanisms—is implemented in smart contracts. And if you can't read those contracts, you're trusting someone else's interpretation.

This is where ChainDecode becomes your security Swiss Army knife. Instead of trusting documentation or marketing claims, you can verify:

- What powers the multisig actually has

- Whether emergency functions really work

- Who can pause or upgrade the protocol

- What hidden fees or limitations exist

Paste any L2 contract address and see exactly what security measures are (or aren't) in place. Because on Layer 2, the contract code is the ultimate truth.

The Bottom Line: Speed vs. Security

Layer 2s exist because Ethereum mainnet is slow and expensive. They make trade-offs—some reasonable, some terrifying—to achieve speed and low costs.

Your job isn't to avoid all risks (then you'd never leave mainnet). It's to understand which risks you're taking and ensure they're worth the benefits.

The protocols following this security checklist are building the future of Ethereum. The ones ignoring it? They're building the next hack headline.

Choose wisely. Your future self will thank you.